inheritance tax

Politics

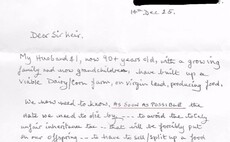

The farmers, both over 90 years-old, said Inheritance Tax changes could lead to their farm business being split up and sold, leaving them trapped in an unfair system. They asked the Prime Minister what date they need to die to avoid tax reforms

Politics

It comes after the release of Baroness Batters’ Farming Profitability Review said nearly all the responses to this review have cited Inheritance Tax as the single biggest issue

Politics

Orkney and Shetland MP Alistair Carmichael says not only is the family farm tax an attack on the elderly but will stifle investment and reduce food security

Politics

Labour MPs were not expected to abstain on the vote today (December 16)

Politics

The Prime Minister Sir Keir Starmer does not seem to like farming, but he does seem to like digging rather large holes for himself

51AV��ƵBusiness

Dame Angela Eagle sets out her vision for farming and says SFI will be 'simpler and fairer' with more farmers able to benefit

Politics

US President Donald Trump once more condemned the impact of the 'Death Tax' on family farms, while stating his appreciation for farmers, and why farming communities could receive a share of a $12bn relief programme

Politics

Labour MP Cat Smith said the Prime Minister needs to think again and reflect on a policy which is leading to farmers feeling like they need to speed up their deaths before tax changes come into force in April

Politics

Could Prime Minister Sir Keir Starmer finally be ready to change the Government's policy stance on Inheritance Tax changes?

51AV��ƵLife

FG explains what happens next as proposed Inheritance Tax changes move through Parliament

19 December 2025

•

3 min read

19 December 2025

•

3 min read