Agricultural Property Relief

Politics

Farmers behind the claim said it is not too late for the Government to pause and commit to a 'full' consultation exercise before implementing Inheritance Tax changes

Podcasts

In this week's Farmers Guardian, we take a look at wills as farmers prepare for the upcoming changes to Agricultural Property Relief

Politics

A judicial review challenging the Government’s proposed changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) has been granted an urgent ‘rolled-up’ hearing in the High Court

Politics

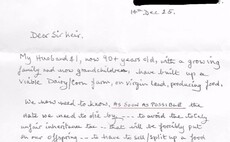

The farmers, both over 90 years-old, said Inheritance Tax changes could lead to their farm business being split up and sold, leaving them trapped in an unfair system. They asked the Prime Minister what date they need to die to avoid tax reforms

Politics

Labour MP Cat Smith said the Prime Minister needs to think again and reflect on a policy which is leading to farmers feeling like they need to speed up their deaths before tax changes come into force in April

Politics

Could Prime Minister Sir Keir Starmer finally be ready to change the Government's policy stance on Inheritance Tax changes?

51AV��ƵLife

FG explains what happens next as proposed Inheritance Tax changes move through Parliament

Politics

The Prime Minister was challenged by Efra Chair Alistair Carmichael at the Liaison Committee last year on the impact of Inheritance Tax changes on farmers' mental health

Politics

South West Norfolk MP Terry Jermy said Labour has an opportunity to reconnect with farmers if it makes changes to APR, adding that the party gained votes from rural communities which revolted against former Prime Minister Liz Truss and previous Tory Governments which 'failed' them in trade deals

Politics

Suffolk Coastal MP Jenny Riddell-Carpenter abstained on a vote to back the Government's changes to Inheritance Tax last week. The Labour MP explains why she could not support the changes at a time when the farming sector is on its knees

02 March 2026

•

3 min read

02 March 2026

•

3 min read